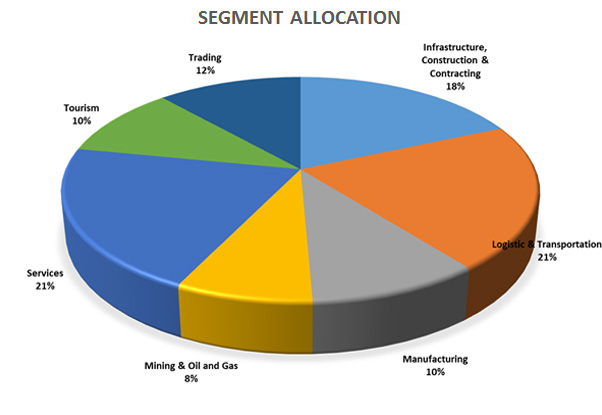

Inma Fund has been working since the first day to provide financing products fast and flexible to suit the needs of small and medium enterprises. The subsidized credit ceiling is RO 500,000 with a subsidized interest rate of 4% (cumulative 7%) and repayment period of up to eight years. Inma has also launched Shari'a compliant products.

Assets financing for acquiring new assets; replacement of existing asset, expansion of capacity or modification.

Asset financing includes Vehicles, Heavy Vehicles, machineries, plant and equipment.

Equated monthly installments to suit your cash flow.

Flexible repayment period of 1 to 8 years.

Facility offer to enhance cash flow and relieve you from the receivable management.

Financing against the accepted and certified Invoice, up to 75% of the invoice value.

Follow up of debts

Maintenance of sales ledger, monitoring and receivables management.

Facility to improve your working capital and cash flow position.

Discounting Sales bills certified and accepted for payment, up to 80% of invoice value.

Against Assignment of Receivables.

Complete package of financial facility is against a particular project; up to maximum of 75% of the project value; against the Assignment of receivables.

Financing includes, Asset financing, Factoring or bills discounting, working capital term loan and non-fund based facilities such as Advance payment Guarantee and Performance Guarantee.

Copyright © 2017 SMEF . All rights reserved. Powered by ADventz